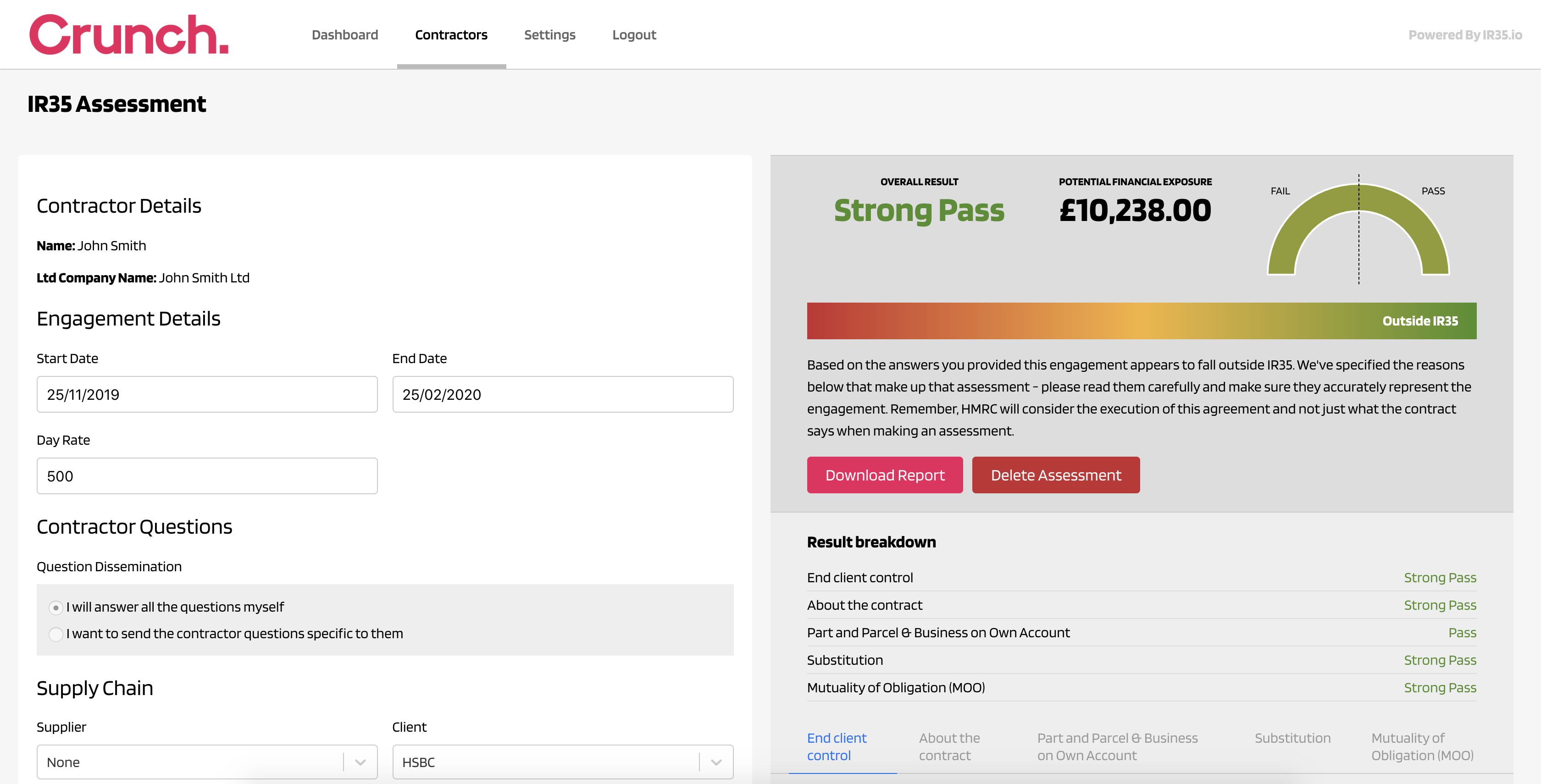

IR35 is changing in April 2020 - are you ready?

-

As of April 2020, it's up to end clients to make IR35 status assessment and issue Status Determination

Statements for all their assignments.

-

If HMRC challenge your IR35 status assessment and you lose, you'll be liable for the missing National

Insurance Contributions and Income Taxes.

-

HMRC's CEST tool is not fit for purpose (by their own admission, they've even called it 'irrelevant' in a

recent tribunal). CEST, when tested against the facts of 22 IR35 tribunals, only got the outcome right eight

times!

-

HMRC will require evidence you've carried out due diligence.

-

Blanket declarations won't work - contractors can challenge your decision and take you to employment

tribunal - you'll need evidence of your decisions.

Call us now for more

information: 03333

110779

Crunch offer the UK's first and best end-to-end solution for IR35. Call us now on 0333

311 0779